Business and Financial

Goodbye to traditional credit cards: the most radical change is here, and banks confirm it

Credit cards have been utilised for years to make purchases, make online payments, pay for subscriptions, or pay for any service or supply. Nevertheless, they have also become an ideal target for digital larceny and scams. The rationale? Their printed 16 digits, which are indispensable for transactions, can also be exploited by fraudsters to gain access to our bank accounts. However, the finance sector is currently undertaking an unprecedented initiative to address this vulnerability. Please note that we will be saying goodbye to credit cards, or at least to how we used to use them.

Mastercard and Visa are currently investing in this change to enhance user security. The objective is evident: to abandon conventional cards with visible numbers and replace them with more secure, intelligent, and, most importantly, more difficult to replicate versions. It is no longer solely about aesthetics; it is about digital survival. This is the reason why the financial sector is preparing to definitively bid farewell to conventional credit cards. Although some individuals may have already experienced the change or are currently observing the changes in their cards, others will observe it over the next few years as a result of a system that is based on technologies such as tokenisation. This system marks a before and after in the way we interact with digital money, protect ourselves, and pay, and we will elaborate on this in detail below.

Farewell to conventional credit cards

The credit card companies that we all use, Visa and Mastercard, are in the process of preparing for a change that will impact millions of people worldwide. Visa appears to have been employing a technology for more than a decade, which, according to official data, has generated over 10 billion tokens since 2014. Revolut and Wise have been providing virtual and physical cards with these new measures for an extended period, and it is estimated that they have successfully prevented at least 650 million forgeries as a result of their dedication to this system.

Additionally, Mastercard is one of the most frequently utilised payment networks on a global scale. Until recently, all of its cards contained a sequence of 16 visible digits that, while necessary for identifying the country, entity, and account type, also served as a gateway for various forms of fraud. However, Mastercard’s new security strategy suggests that it will begin by removing this visible numbering entirely, beginning with its partnerships with financial institutions such as AMP Bank.

Mastercard has stated that its objective is to ensure that all of its users have cards without visible numbers by 2030. This initiative is a wager on a new era in which banking data is not susceptible to malicious digital captures or prying eyes.

Tokenisation is the critical factor: what is it and how does it alter everything?

Tokenisation is the primary innovation that underpins this transformation. It is a system that substitutes conventional printed numbers with a unique, transient code (the token) that is automatically generated each time a purchase is made. This code is non-reusable and ceases to exist upon transaction verification. Therefore, they would be unable to do anything with it even if they were to intercept it.

This system would render it impossible for a cybercriminal to replicate the transaction, even if they attempted to fraudulently use your card. This new protocol enhances cybersecurity to unprecedented levels and eliminates one of the primary vulnerabilities of the current system: the direct exposure of sensitive data.

Absolute user control and biometric authentication

An additional significant benefit of this new technology is that users will have much greater control over their cards. The new cards will rely on biometric authentication to validate transactions, as they lack engraved numbers or visible data. This may include fingerprint, facial recognition, or mobile app authentication.

Furthermore, this new system eliminates the necessity of manually inputting card details for each online purchase. Tokens will be employed by compatible payment platforms to expedite and secure the completion of transactions, ensuring that your information is not stored or disclosed.

When will I obtain my new card without numbers?

The only action you will likely need to take is to wait, regardless of whether you have a Visa or Mastercard. When it is time to renew your current card for a new generation card, your bank will notify you. Some banks have initiated the procedure, while others will do so in the coming years, prior to the final deadline of 2030.

It is advisable to maintain the security of your data and consistently enable two-step verification for online transactions until that time. However, those who have experienced an identity theft attempt or card theft can rest assured that the future is here and it is replete with security.

Discover more from Costa Blanca Daily

Subscribe to get the latest posts sent to your email.

-

Costa Blanca2 weeks ago

Costa Blanca2 weeks agoThis week the DGT will issue over 64,000 speeding tickets

-

Costa Blanca2 weeks ago

Costa Blanca2 weeks agoSix arrested for the use of AI to defraud over 19 million euros

-

Costa Blanca2 weeks ago

Costa Blanca2 weeks agoFire in Benidorm sees two being treated for smoke inhalation

-

Costa Blanca2 weeks ago

Costa Blanca2 weeks agoWhy aren’t salaries in Spain rising while everything else is?

-

Costa Blanca2 weeks ago

Costa Blanca2 weeks agoBeware if you receive an orange envelope in your postbox

-

Costa Blanca1 week ago

Costa Blanca1 week agoSpanish family killed in helicopter crash in New York

-

Costa Blanca4 days ago

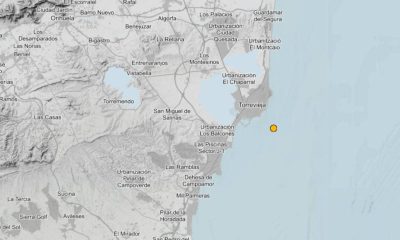

Costa Blanca4 days agoTorrevieja records a 2.8 magnitude earthquake

-

Costa Blanca2 weeks ago

Costa Blanca2 weeks agoPolice are investigating a shooting in Alicante